Survey compares private cloud security vendor Wiz to leaders like CrowdStrike, Zscaler, Microsoft, Palo Alto, Tenable, and others in first-of-its-kind study.

CrowdStrike, Zscaler, Microsoft, Palo Alto Networks, and Tenable are among the leaders in the emerging cloud-native application protection platforms (CNAPP) / cloud security posture management (CSPM) market, according to new end-user data from ETR.

The increasing adoption of cloud infrastructure and cloud-native applications has led to a surge in security threats, necessitating CNAPP/CSPM tools to secure these workloads and applications. CSPM tools scan cloud infrastructure for security risks, such as misconfigurations and compliance violations, while CNAPP tools bring together a range of security features, including CSPM, to provide a holistic view of cloud risk. The CNAPP market is highly competitive, with a mix of established players and newer entrants, and ETR’s latest survey tracks these varied vendors together in a single study.

ETR’s newest Observatory Report and Market Array survey focuses on the CNAPP/CSPM tool market, with insights into specific product strengths, Net Promoter Scores, spending intentions, return on investment (ROI) timelines, utilization trends, and more.

The survey of 313 IT decision makers, of which more than a fifth (23%) represent Global 2000 organizations, yielded critical insights about the CNAPP/CSPM vendor landscape, including:

- CrowdStrike is seen as the most innovative vendor in this market in a write-in response, but survey-takers said if given the chance to rebuild their CNAPP/CSPM tech stack Microsoft would be the most desired vendor. Meanwhile, Wiz was the vendor with the highest agreement on the statement “This product has an innovative technical roadmap,” with 83% of survey respondents in agreement.

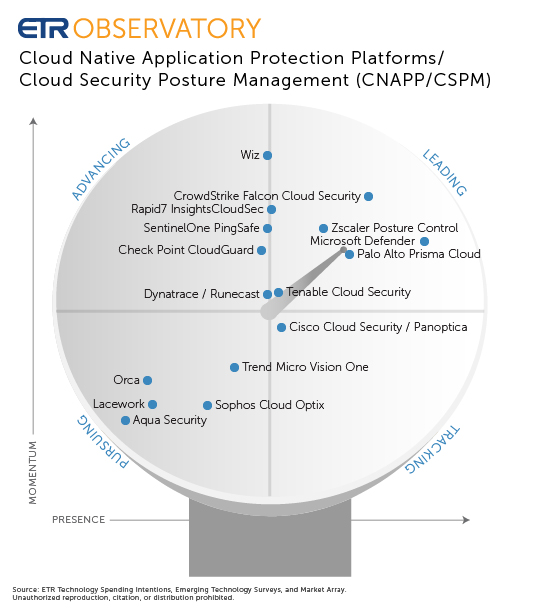

- CrowdStrike Falcon Cloud Security, Zscaler Posture Control, Microsoft Defender for Cloud, Palo Alto Prisma Cloud, and Tenable Cloud Security occupied the Leading vector of vendors in the ETR Observatory Scope, signifying both high spending Momentum and high Presence in the market relative to peers.

- Wiz, Rapid7 InsightsCloudSec, SentinelOne PingSafe, CheckPoint CloudGuard, and Dynatrace / Runecast occupied the Advancing vector in the ETR Observatory Scope, with high Momentum but relatively lower Presence.

- Cisco Cloud Security / Panoptica is the sole vendor in the Tracking vector, with high Presence but relatively lower Momentum.

- Trend Micro Vision One, Orca, Lacework, Sophos Cloud Optix, and Aqua Security comprised the Pursuing vector, with lower market presence relative to the peer group.

- Integration within an existing tech stack and ease of use were rated the two most important features of a CNAPP/CSPM tool. Microsoft Defender for Cloud scored the highest on both ease of integration and ease of implementation, with 88% and 84% of respondents agreeing with statements for those product capabilities, respectively.

- Compared to other vendors in this market, Wiz had the highest spending Momentum, most increasing usage, longest anticipated usage (i.e., lowest expected churn), and overall fastest expected ROI.

To read more analysis of the findings from this ETR survey, read the free ETR Observatory Report for CNAPP/CSPM.